Purchase orders and invoices are two critical documents used in the construction industry. Both the purchase order and the invoice play an essential role in the procurement process, yet they are often confused and misunderstood.

Although similar, each serves a very different purpose in the purchasing process, as well as in the buyer-seller relationship. The key distinction between a purchase order vs. an invoice is who is sending it, and when they send it.

What is the difference between a purchase order and an invoice?

A purchase order is created by a buyer and sent to a vendor for fulfillment. An invoice is sent from a vendor to a buyer to collect payment once a purchase order is fulfilled.

Sending a vendor a purchase order (PO) initiates a business transaction, like a materials purchase. You can think of a PO as an official request to make a purchase for a specific amount. Since POs represent money you no longer have available for other uses, tracking them can help you manage project budgets, job progress, and overall cashflow.

Once a vendor accepts a purchase order, it becomes a legally binding document that holds both parties accountable to the terms of the agreement.

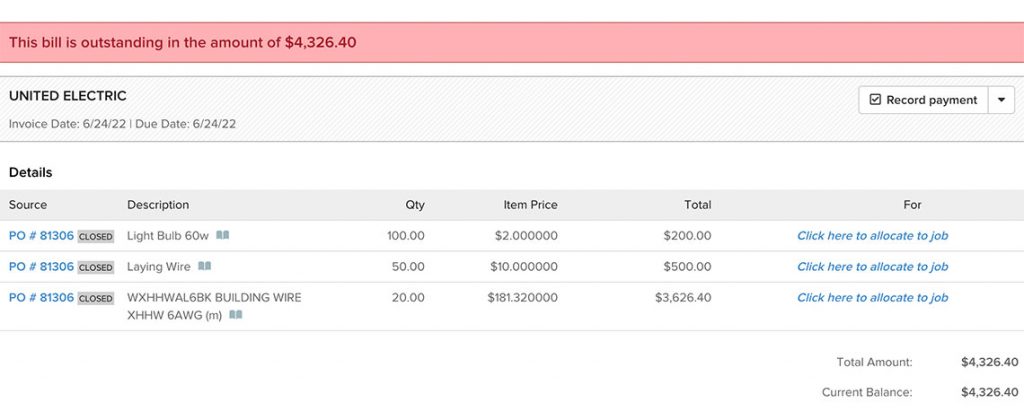

An invoice is sent by a vendor after the PO is fulfilled and the agreed-upon goods and services are provided. It details the final delivery date and amount that the buyer owes. Invoices also usually include an itemized list and terms of the transaction.

To better understand the relationship between the two, let’s look at an example. If while working on a project it is discovered that work has halted because a new hydraulic pump and various other materials are needed. An overview of a typical PO to invoice life cycle might look something like this:

Step 1: A resourcing need is identified by the buyer (hydraulic pump and additional parts/materials).

Step 2: A supplier or vendor is identified who can supply the materials for x amount.

Step 3: A purchase order is developed by the buyer that details what type of pump and materials are needed, how many are needed, shipment info, and agreed upon price.

Step 4: The purchase order is sent by the buyer to the vendor as an official request enabling the vendor to procure the materials.

Step 5: The vendor supplies the order, and then, to request payment, issues an invoice or bill that details the final amount owed by the buyer and the payment terms (a timeline for when they need to pay in full).

While not always a legally binding contract, purchase orders and invoices are a critical part of the procurement process for both small and large trade contractors. Before we get into the details, our biggest piece of advice is to treat them like important financial documents: keep records, produce easy-to-use invoices, and always stick to payment schedules.

Now that we know what the difference between a purchase order and invoice is, let’s break each down in more detail. We’ll also explain how these documents fit into your construction accounting processes.

What is a purchase order?

A purchase order is a document that serves as an official offer issued by a buyer to a seller that specifies the order details for a purchase. The order details will include some or all of the follow: types of items being purchases, order quantities, shipment information, expected delivery date, and agreed upon prices.

The purchase order lets the vendor know that the buyer has full intention to honor a specific sale. It is an effective way to communicate to a vendor what you as a buyer are committed to buying and will serve to protect both parties down the road. In short a purchase order is an official authorization or request from a company to a vendor that a tool or material needs to be purchased.

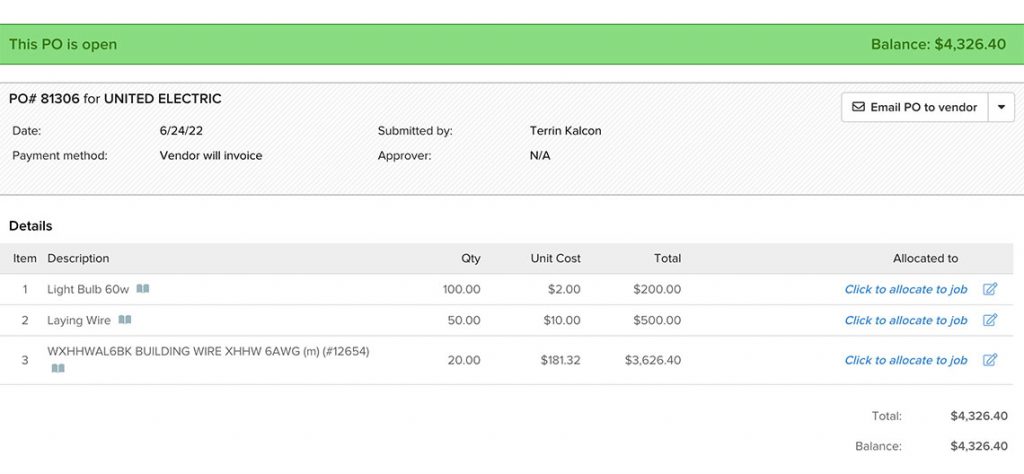

A typical purchase order will vary depending on the industry, the vendor, and nuances in the procurement process, but a typical construction purchase order (PO) will include:

- A unique PO number used for tracking and accounting purposes.

- Date the PO was submitted

- Address of both the buyer and vendor and any corresponding contact information

- Shipping address for the buyer

- Detailed line items specifying the material or product needed, quantity, unit price, and price totals

- Terms and conditions including delivery terms and method

What makes a purchase order an important legally binding document?

It acts as a contract between the buyer and vendor. They are very beneficial for both parties as they can be easily referenced if any disputes or disagreements arise due to price, shipment, or quality.

According to recent studies an estimated 98% of large construction projects go over budget or incur costly delays. Major reasons why include lack of organization, poor communication, and contractual misunderstandings. Purchase orders may seem like a tedious document to include for every project or purchase. However, they are crucial for building a conscientious business and serve as significant accounting and planning documents.

Purchase orders save time and money, and are a valuable mechanism for adhering to budgets and job costing. A properly managed purchase order system will avoid errors and help mitigate against unwanted or unexpected costs.

Most importantly, purchase orders provide protection. A successful business may feel confident in a handshake deal or take the word of a trusted long-time vendor. However, this should be avoided at all costs. It’s crucial to protect yourself should a problem or disagreement occur.

Having a robust purchase order and supplier invoice reconciliation system such as Knowify is essential. Using Knowify ensures that no one at your company will ever be confused again about whether a PO has been submitted on an important materials order.

Tips to improve your purchase order process

By this point, the importance of POs should be pretty clear. They’re essential for any trade contractor that’s looking to maintain a smooth purchasing process and strong vendor relationships. We realize that business processes don’t come naturally to everyone, so we put together some tips to help you streamline your purchase order process:

Use purchase order software

Invest in purchase order management software, preferably a cloud-based solution. We’re partial to Knowify and QuickBooks, but there are other tools out there. The important thing to look for is a tool that can help you automate the process and make it more efficient. Dig into these areas on any demo or trial period.

See how easy it is to create and send purchase orders with Knowify

Standardize your purchase order format

Create a standardized purchase order template with fields for essential information, including vendor details, product or service descriptions, quantities, prices, delivery dates, and payment terms. Consistency will reduce errors and improve clarity.

Include clear terms and conditions

Ensure that your purchase orders contain clear terms and conditions, such as payment terms, return policies, and any special instructions. This helps prevent misunderstandings with vendors.

Assign purchase order numbers

Use a systematic numbering system for your purchase orders. This makes it easier to track and manage orders over time.

Verify vendor information

Double-check vendor information to avoid sending orders to the wrong address or contact. For bonus points, keep an updated vendor directory with accurate details (this can be a simple spreadsheet).

Set up an approval process

Implement an approval process for purchase orders, especially for larger expenses. Define who needs to authorize each purchase before it’s issued.

Establish vendor relationships

This extends far beyond purchase orders, but we can’t stress how important it is to build strong relationships with your vendors. Open communication can lead to better pricing, more flexible terms, and quicker order processing.

Track order status

Regularly monitor the status of your purchase orders, from creation to delivery. For complex orders, or orders with a longer lead time, stay in touch with vendors to get updates on order progress.

Communicate changes promptly

If there are any changes to an existing purchase order (e.g., quantity, delivery date, or item), communicate these changes to the vendor immediately and update the purchase order (or issue a new one) as needed.

Keep records organized

Maintain a well-organized record-keeping system for all purchase orders, including digital copies and hard copies if necessary. This will help with auditing and tracking expenses. A solution like Knowify can help with this process.

Review invoices carefully

When you receive invoices from vendors, compare them to the corresponding purchase orders to ensure accuracy. Resolve any discrepancies promptly.

Analyze purchase history

Regularly analyze your purchase history to identify trends, cost-saving opportunities, and potential areas for improvement in your procurement process.

Consider bulk ordering

If you routinely make larger purchases of the same type, or many smaller orders from the same vendor, explore opportunities to consolidate orders and negotiate bulk pricing to reduce costs and simplify logistics. Consider also pooling resources with other local tradespeople and making collective orders.

Review and optimize

Periodically review your purchase order process and seek ways to optimize it for efficiency and cost-effectiveness.

What is an invoice?

In a typical business transaction, there are two parties involved: a buyer and a seller. This all seems straightforward but how much exactly does the buyer owe? What specifically are they paying for and how long do they have to make the payment? An invoice is issued to provide clarity on all of these questions and to officially set out all of this information.

A sales invoice is a formal payment request issued by sellers to buyers, detailing the items and services provided. It plays a crucial role in the accounts receivable process, helping with accurate payment tracking.

In construction, an invoice is a document issued by a supplier or contractor officially requesting payment for any work or service that has been provided. It should be clear how much is owed, including an itemized list of goods and services provided, due date, and the terms of the transaction.

In the construction industry invoices are key for progress billing. Keeping track of partial payments, late fees, deadlines, and materials and services are crucial for long-term and large-scale projects. Most large projects need to be billed on a percent-completion basis; further complicating matters, it is very common for those projects to be broken down into phases that are individually billed by their percent-completion. Thankfully, progress billing is a key feature offered by Knowify.

Invoices come in many different shapes and sizes but typically they will include:

- Addresses and business information for both the buyer and seller

- Invoice number

- Date the invoice is created

- Terms

- Specific descriptions of the rate, quantity, and amount of goods and services.

- Tax amount per local and state regulations and law

- Total amount owed

It should be noted that an invoice is not the same as a sales receipt. The key difference is that an invoice is a request for a payment, and is issued before money is received. A receipt on the other hand, is issued after money has been received.

For the construction industry, it’s also important to set up invoices correctly based on billing style, such as AIA, progress billing, or requesting payments in full.

What makes an invoice important?

An invoice is an important event from an accounting standpoint as it triggers the accounting entries in the books of both the buyer and seller and is a catalyst for a business to actually receive money that it’s owed. Although not legally binding by default, an invoice can be if agreed upon by both parties. It’s strongly recommended to take this route and secure it as a signed contract to help protect yourself and ensure payments should a party refuse to pay.

An invoice should be sent as soon as possible to ensure healthy cash flow. Most importantly, an invoice ensures proper accounting and documentation of all transactions which is essential for running an effective, and legal, business operation. Lastly, a proper invoice is a record of a transaction that will conveniently split out and identify tax dollars which is required by law for transactions involving registered businesses. accounts receivable accounts receivable accounts receivable.

Tips for improving your invoice process

Sending and managing invoices efficiently is crucial for the financial health of any trade contractor. Similar to our PO tips above, we put together a few quick recommendations for streamlining and organizing your invoicing process:

Use professional invoicing software

Invest in a reliable invoicing software like Knowify, QuickBooks, or another vendor. These tools can help automate the invoicing process, make it easier to track invoice status, sending payment reminders, and simplify payments.

See how easy it is to make and send invoices with Knowify

Create clear and detailed invoices

Make sure that your invoices contain all necessary information, including your business name, contact details, invoice number, payment terms, and a breakdown of the work completed. Clarity is the key to avoiding disputes.

Establish payment terms

Though they should be agreed to long before you send your first invoice, clearly define your payment terms on the invoice. Specify the due date, late payment penalties (if any), and accepted payment methods. This helps set expectations for your clients.

Send invoices in a timely manner

Send invoices as soon as the work is completed or according to your predetermined billing schedule. Prompt invoicing can lead to faster payments.

Offer multiple payment options

Make it easy for your clients to pay by offering multiple payment options, such as credit card, bank transfer, or check. The more convenient it is for clients to pay, the quicker you’ll receive payments. Not currently set up for credit card payments? Many invoicing tools offer payment processing as a feature, so look into this during demos and trials if it’s of interest.

Set up automated reminders

Use invoicing software to set up automated payment reminders. These reminders can help nudge clients to pay on time and reduce late payments. We understand a desire to get paid for your work, but this is one area where we recommend treading carefully. Reminders are important and you should use them, but do so in a way that respects the client relationship.

Monitor invoice status

Regularly check the status of your invoices. Use your invoicing software to track which invoices are paid, pending, or overdue. This will help you follow up on overdue payments promptly.

Implement a late fee policy

Clearly communicate your late fee policy to clients on the invoice and enforce it consistently. The promise of late fees are a powerful tool to ensure you get paid on time.

Keep detailed records

Maintain organized records of all your invoices, payments, and receipts. This will help you track your business finances and make tax season easier. Again, this is something that invoicing software should be able to manage for you, simplifying your operations significantly.

Send thank you notes

Whether sent digitally or the old fashioned way, after receiving payment, consider sending a thank you note to your clients. This not only shows appreciation but also reinforces a positive business relationship.

Give your clients a way to pay online

Most invoicing software is going to support online payments. This makes it a lot easier for your clients to pay, and an easier payment process often leads to more on time payments.

Seek professional advice

If you’re new to using invoices, and unsure about the tax implications, financial management, or other invoicing-related matters, consider consulting with an accountant. This will ensure you follow all applicable laws, are set up properly to file taxes, and have a trusted resource you can turn to for financial guidance.

Summary

Both purchase orders and invoices serve as vital business functions for any construction project. It is important for project managers and business owners to know the difference and how each can be leveraged to make better business decisions. Investing in planning and accounting will go a long way in ensuring an efficient and lucrative project.

Schedule a demo today to see how Knowify can radically improve your invoicing, document storage, and management today!