For small to medium-sized (SMB) trade contractors and remodelers, efficient project management and accurate accounting are critical to running a successful business. Managing these two facets often requires specialized tools that cater to the unique needs of contracting work.

Knowify and QuickBooks are two such tools, each excelling in different areas but working together to provide a comprehensive solution. In this post, we’ll explore the differences between Knowify and QuickBooks, and how integrating these platforms can optimize both project management and accounting for contractors.

Knowify is designed with contractors in mind, offering robust features for detailed project management. It handles everything from contract management to project scheduling and task completion. With Knowify, contractors can easily manage contracts, create and track change orders, and monitor project progress in real-time.

One of Knowify’s key strengths is its ability to manage complex contractor-specific needs. For instance, Knowify excels in job costing, allowing contractors to track costs at every phase of a project. Additionally, Knowify’s retainage management ensures that retention amounts are correctly handled throughout the project lifecycle. Unlike general accounting tools, Knowify provides detailed breakdowns and projections at the project level, helping contractors stay on top of their budgets and profitability.

Knowify’s user-friendly interface makes it easy to access critical project metrics. Users can see a comprehensive view of profitability, budget versus actual spending, and overall project health directly on their dashboard. This visual clarity helps contractors make informed decisions quickly and efficiently.

QuickBooks is renowned for its comprehensive accounting capabilities. It manages invoicing, payroll (with an integration like QuickBooks Payroll), expense tracking, and financial reporting with ease. This makes QuickBooks an essential tool for handling the bigger picture financial needs of any business.

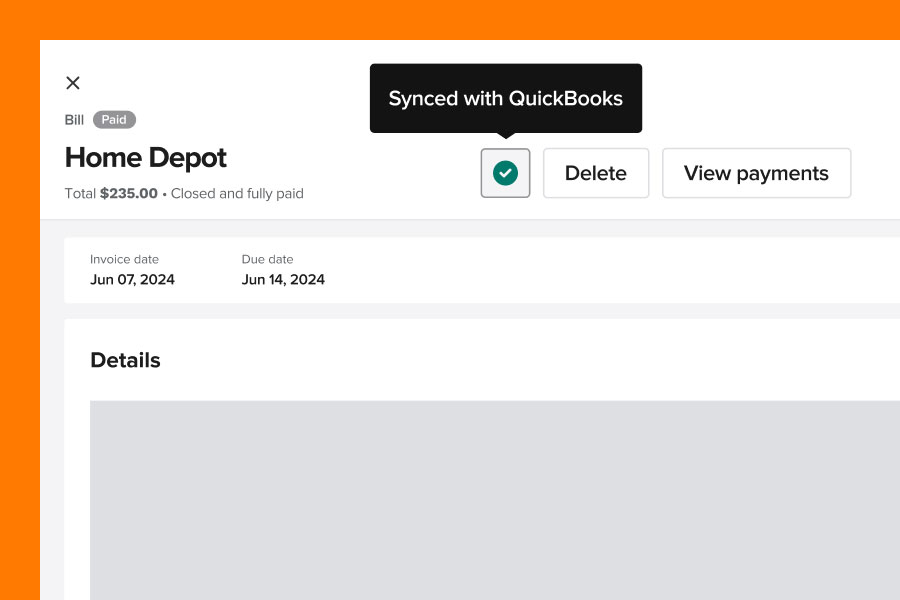

When integrated with Knowify, QuickBooks enhances the financial management of contractor projects. For example, payments recorded in Knowify can be seamlessly synced to QuickBooks, ensuring that all financial data is consolidated in one place. This integration simplifies the bookkeeping process and ensures that financial records are always up to date.

QuickBooks offers a wide variety of financial reports that are crucial for thorough accounting. These include profit and loss statements, balance sheets, and cash flow reports. While Knowify focuses on project-specific financials like work-in-progress (WIP) reporting, QuickBooks provides a broader view of the business’s overall financial health.

Integrating Knowify with QuickBooks can significantly streamline operations. For instance, invoices generated in Knowify can be automatically sent to QuickBooks for recordkeeping. This ensures that all financial transactions are accurately recorded and managed without double data entry.

The sync between Knowify and QuickBooks ensures consistency and accuracy in both project management and accounting data. Contractors can trust that their financial data is reliable and that their project tracking reflects what’s going on with a job in real-time.

Using both tools together enhances team collaboration by centralizing project and financial data. This unified approach ensures that everyone, from project managers to accountants, has access to the same information, fostering better communication and coordination.

For optimal efficiency, contractors should use Knowify for project-specific project and financial management and QuickBooks for general accouting. This division of labor ensures that each platform is used to its strengths, resulting in better managed projects, more accurate financial records, and a rich history of product data that can be used to support strategic decision-making.

By integrating Knowify and QuickBooks, contractors and remodelers can significantly enhance both their project management and accounting processes. Knowify offers the detailed project and financial management tools contractors need, while QuickBooks provides the overarching accounting support needed to run your business. Together, these platforms provide a powerful, complementary solution that can transform the way contractors run their businesses.

Watch QuickBooks expert Hector Garcia tour Knowify and learn how its construction specific features build on QuickBooks Online to give contractors and accountants tools to manage project-level and business-level finances. Watch the video.