If you’re bidding jobs or building budgets based on wage rates alone, there’s a good chance you’re bleeding margin—and don’t even know it.

Most contractors underestimate labor costs by 20–35% simply because they ignore what it really costs to put a person in the field for one hour.

Let’s fix that.

What Is labor burden?

Your labor burden is the total hourly cost to your business for a field employee. That includes more than just wages.

Here’s what gets added to the wage to calculate true hourly cost:

- Payroll taxes (Social Security, Medicare, state)

- Workers’ comp and general liability insurance

- Paid time off (vacation, holidays, sick)

- Health insurance or 401k contributions

- Training and certifications

All of the above are considered indirect labor costs. Use them to calculate your labor burden rate. Here’s the formula:

Labor burden rate = (indirect labor costs / direct wages) x 100

Including costs like tools, PPE, cell phones, gas stipends, etc. is optional, but if you can account for them, your labor costing will be that much more accurate.

A simple labor cost calculator

With your labor burden rate, you can calculate the true hourly cost of each employee.

Here’s an example:

- Base wage: $30/hour

- Taxes/insurance/benefits burden: 32% → $9.60

- Small tools/PPE/phone allowance: ~$1.50/hour

True cost per hour: $41.10

Now imagine budgeting 1,000 labor hours at $30/hr when it’s really costing you $41/hr. That’s an $11,000 difference on a single job.

Why this matters more than ever

In tight-margin environments, accurate labor costing is the difference between profit and break-even.

Tracking true labor costs helps you:

- Bid with confidence

- Price T&M and service work more accurately

- Control labor spend on multi-phase projects

- Justify rates to GCs or clients who push back

It also gives you a clearer picture of which crews or job types are actually profitable.

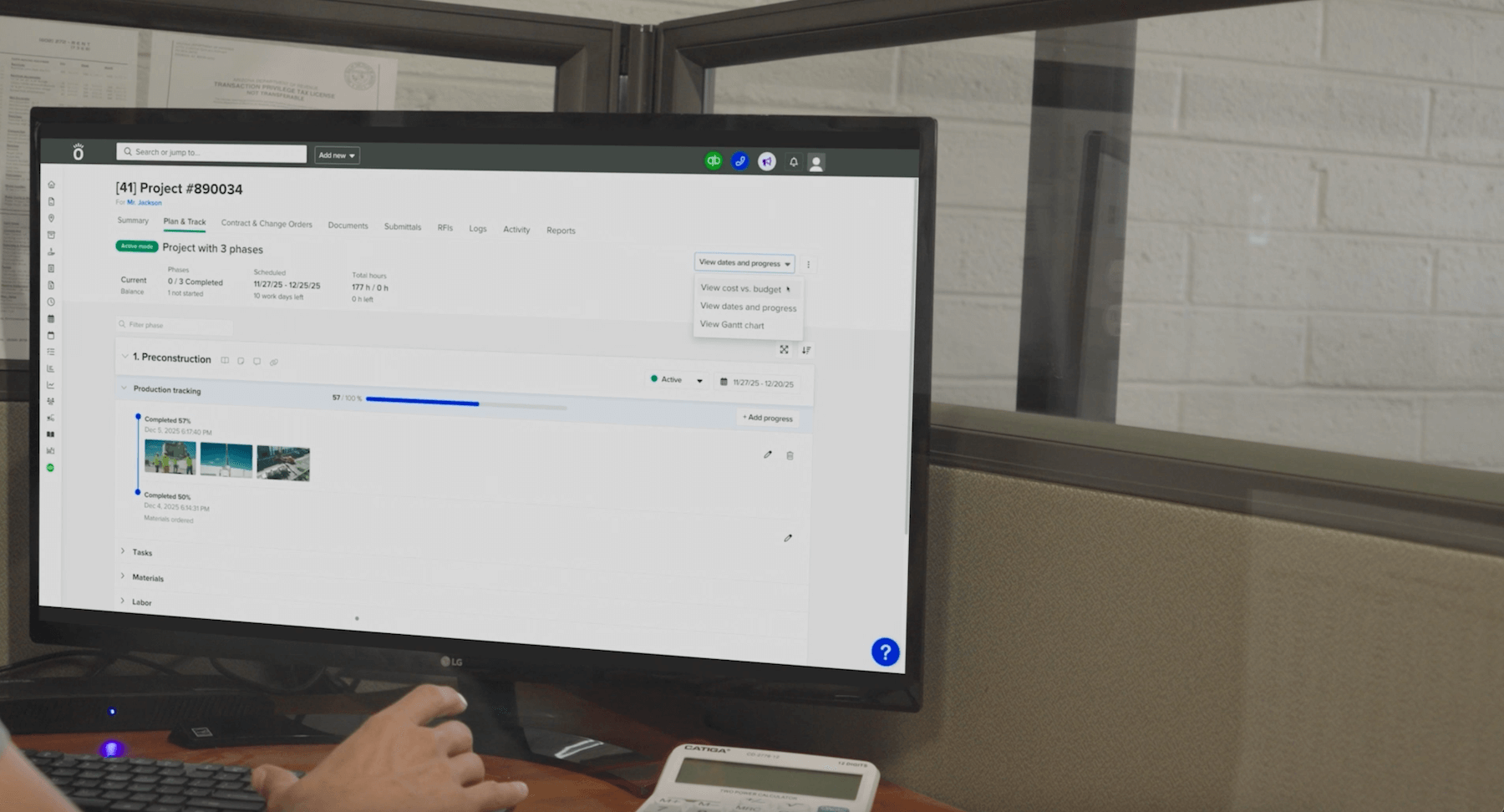

How to make It easy with Knowify

If you’re a Knowify customer, you already have a labor burden calculator built in:

- Save burdened labor rates per employee

- Apply them automatically to your job budgets

- Track time from the field with the Knowify app

- Get accurate job costing in real time — no spreadsheets, no manual entry

- Sync with QuickBooks for the full financial picture

It’s one of the highest-impact features in the platform.

Test drive Knowify’s labor tracking and costing tools today with a 14-day free trial.

Final Tip

If you haven’t revisited your labor burden in the past 6–12 months, do it this week.

Costs have changed. Crew makeup has changed. Your pricing should reflect that.

QuickBooks

PricingTraining & support

QuickBooks

PricingTraining & support