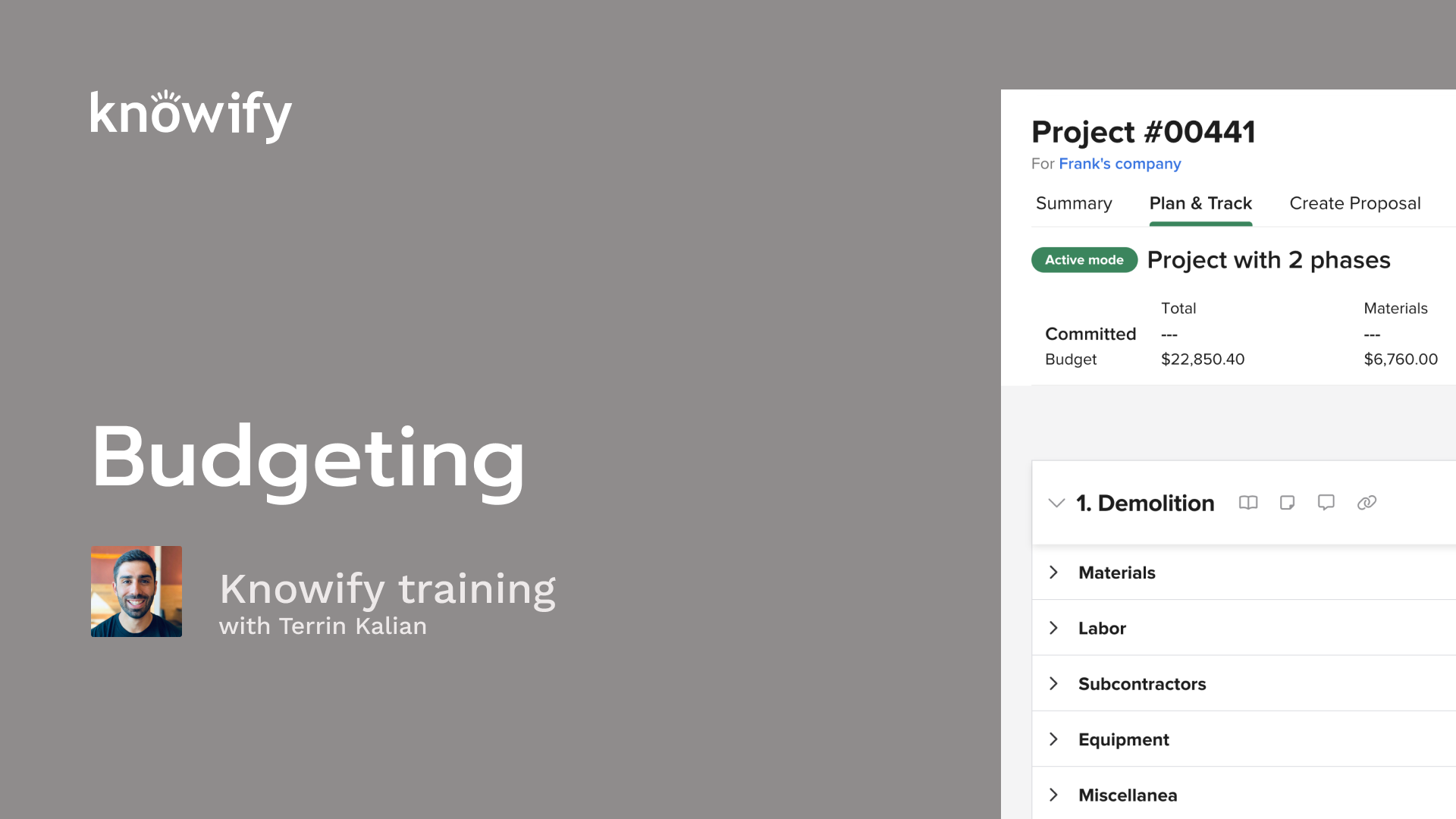

Alright. Welcome in, everyone. Appreciate you taking the time to join in and learn a little bit more about Noify. Today in our deep dive series, we are discussing budgeting at Noify in Noify. If you are familiar with these series of webinars, essentially, what we do is pick a specific topic twice a month and go into a little bit more of a long form training and discussion and explanation of this specific feature set in, nullify. And we try to do a bit of a cycle. So we redo topics that we've done in the past just so we can make sure that all of this is as up to date as possible since nullify is always growing and changing every day. We're always making new improvements to the software. And since all of these are recorded, you can always access them, at a later date. So, again, as we are improving Nullify and continuing to do these webinars, this is, always, updating the knowledge base of different webinars and different topics so that everything's as up to date as possible. And budgeting is really where we start everything off. This is kind of topic number one in our series. So if you're new to this series, this is a great part, place to start. And if not, hopefully, we have some new stuff here for you to learn around budgeting, that, helps you get a little bit more around, NoFi. But thanks everyone again for joining. Welcome in, and we will, jump right in there. Just for starters, to introduce myself, if you don't know me, my name is Taron. I manage customer experience at NoFi. Basically, my job is to make sure that everyone's as happy with Nollify as possible, whether it's the product itself, or how you interact with our teams or anything like that. Been working, at Nollify for a little over, ten years now. So you may have actually worked with me on a couple calls in the past, whether it's a, you know, support call, a training call, or we're giving product feedback. I try to jump in and chat with as many of you guys as I can. And just to quickly go through the agenda for today's meeting, I always start with a couple of slides just to kinda discuss the topic at a high level before we even get into Noify. So we'll be discussing the concept of what is budgeting, you know, what do we mean when we talk about budgeting in Noify, Then getting into the different types of costs that we can track in Noify, and then what it looks like, what our plan and track section looks like in Noify where we set up our budgets. That's when I'll then open up my account so I can give you a demonstration, show you a little bit more about what this looks like in real time, and then we'll do a q and a at the end once we've finished all of that scheduled agenda. If you have questions during the webinar, that is great. You can throw them in Zoom's q and a. I have my associate, Vin, who tries to answer as many as he can during the session. And then anything else that's a little bit long more long form, I'll answer at the end of the webinar as well just to make sure that we do our best to get all of your questions answered. But with all of that being said, I'll go ahead and kick us off, and we'll start with the very high level what is budgeting? Just defining budgeting when when we discuss this in Noify. And to put it really simply, our budget is how much we expect to spend on a project. So not necessarily how much we are going to spend because we may actually end up spending less or more than we initially budgeted. But here's how much we, with the information we know, can expect to spend by the end of this job. So once this job's finished and I look back at everything, what do I think that number is gonna be? How much will I have spent on this job? And it's a common misconception. A lot of people think, okay. Well, how do I know how much material cost is? I haven't bought everything yet, and that's not really what this is meant to be. It's a way for us to say, based off of what I'm gonna buy, I think I'm gonna spend sixty seven hundred dollars in materials. And that's gonna be a powerful number for us to use through the life of the project for a variety of reasons. One more than anything is when I quote a price to my client, I wanna know how much I'm gonna spend so I can make sure that when I quote a price to them, it, is not just gonna cover my cost, but also has some profit included. There's room for contingency, overhead. I wanna make sure that all of that's, available. In order for me to do that, I need to first understand how much I expect to spend on the job by the time it's complete. Another common misconception when it comes to budgeting is that, people often think that the budget is equal to the contract contract value. Right? My budget is however much I quoted to them. As long as I come in under that budget, I should be profitable. Right? But the problem with that is if we're aiming for breakeven just based off of overhead expense and costs that are incurred outside of our direct project costs, breakeven jobs end up losing money. So our budget isn't the amount that we quote to the customer. It's actually the amount that, again, we hope that we have spent by the time the job is completed. Another place where it ends up coming in handy is things like project progress and web reporting. So, obviously, we know that our cost versus budget number isn't always gonna be a perfect way to determine how far along we are on a project, but it is a really useful number for us to understand it from an accounting standpoint. So, we get the idea of, well, if I look at how much I spent, I've spent five thousand dollars and I budgeted ten thousand dollars, I can kind of understand that I'm roughly halfway done with the project from a financial standpoint at least. Doesn't necessarily mean that by end of project, I will have spent ten thousand. But according to my best guess, we think we're about halfway done with our spending. And then when, we get into our WIP number, that helps us understand, well, here's how we can project our profit, and our final revenue or or sorry. Our final profit on the project based off of, any, spending we've done to date, compared to how much we said we were gonna be earning on the project. Now that's the idea of what is a budget. Right? Just hammering home this concept of our budget is the amount that we hope to have spent by the end of this job. The we expect to have spent by the end of this job. But this could be more detailed than just one dollar figure. Right? That one dollar figure is extremely powerful. That is the one that ends up being the most important in a sense. Here's the total amount spent, the total amount budgeted. But sometimes we need to understand it in a little bit more detail, and this is where we break down our budget into categories. Now in Noify, we offer materials, labor, subcontractors, equipment, and miscellaneous budgets. So when I look at a job that's over budget, I don't wanna just say, okay. We spent more than expected. Bummer. I wanna be able to say, well, why did we spend more than expected? Is it that we are estimating things too low? Do things cost more than we expected? Is it that we we are, you know, underestimating the number of things that we need? It's less materials. Is it taking longer than expected? And for us to get those answers, we need to get more detail in our budget. So we can create a budget for by materials, which is gonna be a list of the different items that I'm buying specifically for that job. I always like to say materials, when we compare that to equipment. Materials are burned on the job, whereas equipment might be something that I still retain after the job or, you know, it still exists beyond the job for other jobs in the future. We also have labor, which would be our employee or resource time that's used on the job. So a little bit more abstract as opposed to I handed someone, ten dollars. They handed me materials. I use it on the job. This is my employee, cost me money every hour that they're on the job site. And since we know what job they're working on, I can look at how much that employee cost me per hour to understand how much I'm spending on this job and the labor on this job as we go through it. And so when we budget labor, we have the ability to say, hey. Here is the amount that we have spent based off of the number of hours that we put in the system for each resource we have. Then when it comes to subcontractors, what we're budgeting for is outside parties, so additional contractors or, companies that are hired to work on a job. So bit of a common confusion here that can happen is is it a subcontractor or is it labor? If they don't if they're not employed by you, if they're not at ten ninety nine, if they're not being tracked hourly, best chances are it's gonna be a subcontractor. So this is gonna be more of a vendor relationship than a, payroll or employee based relationship, and that's when we know that, subcontractors come into play. For equipment, we actually have two categories that we manage. So this is both the idea of, well, I own equipment that costs me money to own. I wanna see how much it costs me on a job by job basis as I, use that on a job. But, also, I rent equipment from an outside party. And so, if we're comparing this to our two previous categories, we have the idea of what we call internal equipment, which is my owned equipment. I track how much time it's on a job. That's like my own laborers on a job. I wanna see how much it cost me per hour used. But if I'm renting equipment, it looks a little bit more like a subcontractor or even a material purchase, and that it's a vendor interaction. I gave them money. They gave me the equipment on a temporary basis. Then the final category that we allow is miscellaneous or miscellaneous. This is the idea of something that doesn't fall into the other four categories. My go to example is always permits. Right? A permit's not necessarily material. I may be, you know, communicating with another party, you know, the government office that issues the per the permit, but they're not a subcontractor. I'm not hiring them. It's not equipment. Miscellaneous is a great place for us to, be able to budget for things that don't fit into the other categories. And I say, well, here's everything we need to spend as far as our base construction categories go, but I also know that I will need to buy miscellaneous. I'll need to buy permits. I'll need to spend money on hotel rooms for employees, things like that. And I wanna be able to still track the cost of that as it pertains to the job, and that's where these categories really come into handy. Now when we create budgets in Noify, they'll be in the plan and track section if you're familiar with it, and we'll have two real options for how this budgeting works. Number one is gonna be the idea of a lump sum budget, which is where I just write in a dollar figure. And this is very acceptable behavior. Right? A lot of people might be a little uncomfortable about the idea of just writing in a dollar figure. There's nothing wrong about it. There is more power to our next option, which is an itemized budget. But what a lump sum budget allows us to do is just tell Noify, hey. By end of project on this phase, I will have spent four thousand dollars in materials. And then I can start tracking all of my actual cost against that four thousand dollars. And it's much better to have that budget in than to have nothing at all even if it's not as detailed. And, again, this could be set for each category that we have. So here's my budget for materials, for labor, for subcontractors, etcetera. When we track our actual cost, it can still be itemized. Even though we have a simple budget, four thousand dollars, I could still see the individual lines that make up the actual cost that we end up comparing to that. But, again, it's better to have a lump sum budget than nothing at all just because it gives us some kind of target to track, to strive towards as we start tracking our actual cost down the line, and it gives us a sense of progress through the job. So, again, as you set up a project, it's always a good idea to have just something in there. Even if it ends up being wrong, at least that gives us a jumping off point if we go over or under to see why was it wrong, where did we spend more or less money than expected, and where can we improve in the future. But if you have more information and can be more detailed about it, you can create itemized budgets to, give yourself a little bit more power in all of your actual tracking of, costs in nullify and a little bit more detail in your reporting that comes out of nullify. So when we look at this in our different categories, the idea of an itemized material budget is instead of writing in twenty seven hundred dollars, I could say, here's everything I need to buy in materials. Here's how many of those I need to buy, and here's how much it's gonna cost me per each. Using that information, nullify is gonna do a quick simple calculation of here's the budget, and I can still track the actual cost completely separately, but still against that twenty seven hundred number of material budget, at any point through the life of the job. But I also have the ability to later on use those, itemized budget lines to say, I'm now gonna buy the nails that I expected, the lumber that I expected, the strand board that I expected. I can go through this and I use the information that was entered previously to skip a step of entering information in the future. And then there's a lot of power to that. It's a lot of time saving as well. The same thing goes for our labor where it may not might not be a list of materials that I need to buy, but a list of hours that I'll need to, take to complete this job. And whether that's individual employees, I need Tim on the job site for ten hours or types of people that I know. I'll know I'll need a foreman, a laborer, whatever the role is gonna be in Novi. And then I could figure out who it's actually gonna be later down the line when I'm tracking my actual cost. But when I'm budgeting, I could just say, I need four men on the site for forty hours. How much is that gonna cost me? And know if I can use the budget rates of, affiliated with your different roles to say, based off of the number of hours it's gonna take you, here's how much you're probably gonna end up spending on labor, while you go through the life of the job. Subcontractors can be budgeted, in a list of lines as well, where I could say, I'm gonna need to hire an electrical subcontractor, for a thousand dollars. I'm gonna need to hire a drywall guy for eight hundred dollars. I can break that all down into an itemized list as well. So, again, I could track my actual versus my budgeted there. For equipment, we have, again, that internal option where I could say, I need x number of hours of this type of equipment, excavator, you know, dump truck, whatever it's gonna be. Or I could, put together a more itemized list, like, with a material purchase where I could say, I'm gonna need to rent a dumpster for fourteen days, and I can track that equipment rental, against what we had budgeted there as well. And then the last option, that miscellaneous, that comes into play very similarly to materials as well, where I could just put in a list of things that I'm gonna need to buy that aren't materials, with their corresponding quantity and unit cost so we could see, okay. Here's how much we'll end up spending on things that aren't related to our materials, labor, subcontractors, or equipment. And so that's where we get a lot of benefit out of that. Itemize is being able to not just start and see total cost versus budget of the job, but how much am I spending on individual pieces of individual budgets inside that job? And that's kind of a good segue for the idea of getting more specific in our budgeting, by building what we call phases. So, when we have those categories that we lined out earlier, those are the default categories available at Noify. But maybe you have more technical needs than just that base set of categories that we wanna track the cost versus budget of. Maybe I have stages of a project that I need to track the, cost versus budget of. Maybe I have, different, bedrooms that I'm working on. Maybe I have different whatever it's gonna be. We call them phases. A lot of the softwares will compare this to something called, like, a milestone where this is gonna be a way for me to schedule the job in pieces, but it's also gonna be a way for me to track the job in pieces. And each of them can have their own cost versus budget at that category level. So, yeah, we have the material cost versus budget of the job, but then each phase within the job, demolition, framing, drywall, painting, those can have all of their own cost versus budgets that can be very detailed at the itemized level so that, again, I start at the high level. Here's my job's cost versus budget, but I could drill it all the way down to here's how much I spent on this material of this phase of this job. So I'm really starting at the, you know, high level, but drilling down to that nitty gritty. Here's what happened on this job so I know exactly, where I can prepare to be a little bit stronger in the future if I have a similar project. Now, again, for this webinar, I'm going to, focus a lot more on budgeting, than, by actual costing. But I'm gonna pull up my account now and show you a little bit more about what this all looks like. I'll start a new job. And one thing that's worth noting, if you, are unfamiliar, is that I'm gonna use the professional job costing style, which lets us set up a budget before we set up our contract. If you use simple or advanced, it sets up a contract first, and there's nothing wrong with that. A lot of people do like to do that. But, when we talk about this workflow in Notify of budget, bid, tracking, budget first, this is where professional comes into play. So I can use the information from my budget to then, create a more detailed, contract with a price that's more likely to provide me with the profit margins that I'm targeting. Now when I create a job in professional, it pulls me into this plan and track view. This is gonna be my cost tracking center of of any job in where nothing that the client sees comes in here, but this is where I can write in how much I expect to spend, and this is where I could track how much I actually spend through the life of the job. And to start budgeting, we create a new one of those phases that I mentioned earlier. So I'll say add a new phase, and I almost always start by calling my phase demolition, step number one. And this is where we can build quick lump sum budgets. For demolition, I need a thousand dollars in material and two thousand in labor and a fifteen hundred dollar subcontractor, just a hundred dollars in equipment, and a hundred dollars in miscellaneous. And that's really quick, easy budgeting. It may not be detailed, but I can use this. I now know the job should cost me forty seven hundred dollars, and I could start tracking all of my actual cost against these, categories that I laid out. But when we start getting more detailed, I can say add a phase now for framing. And instead of me writing in a materials budget, I'm gonna say add materials. Now I could say I need to buy, studs. Here's my two by fours, and I'm gonna need to buy two hundred of these. Now the unit cost comes from the notify catalog, and this could be updated. One change we made not too long ago is that, from here, let's say I know that the price of lumber has changed. I could say, actually, lumbers are now seven dollars. And when it sees a mismatch between what I wrote in the unit cost and that item's, usual cost, this icon will show up or it can click this. And now it's gonna update the cost of lumber so that moving forward, if I say two by four, it knows to use the seven dollar, the new cost instead. And so that's one handy tool you do have while budgeting at any point in time. But I'll put in the rest of the budget. I also need to buy my strand board and boxes of nails. I could put in all of my quantities here. And now I have my materials budget for this project. It should cost me about twenty nine hundred, and he's here's the detailed breakdown of this. For labor, similar type of workflow. I'll enable labor as one of my budget categories, and I can either say, I'm gonna need to have a foreman on-site. Or if I know who I'm gonna have on this job, I could say it's gonna be Charles, and you could see that the hourly cost has updated here. Now the idea of budgeting labor here. If I say foreman and it says hourly cost ninety dollars, this is the budget cost that I have affiliated with foreman, which I'll show you in just a moment. And that's great if I don't know who it's gonna be because this should give me an idea of how much it cost me per hour to have a foreman on-site. But if I know exactly what it's gonna be, it will be frank. Now I could see if I had budgeted the base rate of ninety dollars for foreman, I would have come in under budget if it ends up being, or sorry, over budget if it ends up being frank on the job site the entire time. And so this is an important thing if we know who it's gonna be. Having the actual cost can always give us the more accurate budget, but there's nothing wrong with saying, I just know it's gonna be a foreman, and that's what I need to budget here. So where does this number come from? If I go to my admin section under rates and resources, every resource has its own labor burden. So this isn't necessarily the amount that they make, but this is how much they're paid, how much they earn in benefits and fringes, their taxes, insurance, additional union wages. And then we even have this other field for things that, might not be in our other columns, but I want factored into their cost per hour. And this is what we end up tracking when we actually track the cost of this person as they enter time in, against the job in Noify. But for budgeting purposes, if I go to my role section, I could see here the different roles that we budget for, and I actually know that a lot of my foreman make more than ninety dollars an hour. I'm gonna actually up this budget here. I want to budget a hundred and thirty dollars an hour for, my foreman time. Now even if the most expensive foreman I have costs me a hundred and twenty dollars an hour, there's nothing wrong with having an increased number as our budget within reason. We don't wanna over overestimate the cost of this job. But what's nice about this is that even if my estimate of hours ends up being incorrect, then my, total cost of the job may still end up being correct, because we overestimated the amount of cost per hour. And so whenever we have these individual rates affiliated with our budgets, there's nothing wrong with rounding up a little bit and trying to, estimate a little bit of wiggle room into our budget. So I'm gonna, come here, add a laborer, and let's see, updated foreman, a laborer for forty eight hours, a foreman for ten, and now I have my budget here. That same rule does apply for materials. So, like, let's say I know that a strand board usually cost me seven dollars and fifty five cents each. There's nothing really wrong with estimating it at eight dollars just so, again, if I end up needing more than expected, that's built into this. We don't have to have our actual cost match these budget costs by any means. They're just for the sake of estimating final cost at end of project. Now for our other categories here, subcontractors, again, we always have that lump sum option, which is pretty common for subs. But here's something that's relatively new to nullify is that I can actually add unassigned work and line out a budget for subcontractors, where I could say, I need to hire a drywall contractor, and they will probably charge me four thousand dollars. And I could have multiple of these painting for twelve hundred dollars and just keep putting these together and then track all of our actual contracts against what we laid out as our budget for subs. What we can also do if at this point that we're budgeting, we already have quotes from our subcontractors is I can actually add a subcontract at this point in the process just so our actual subcontract ends up serving as our budget for this phase of the job. Not always common. Usually, we track actual cost and actual contract values when the job is live. But if you know ahead of time, let's say it's a sub you work with very often and you know what their prices are gonna be, that's an opportunity that you have to kinda just skip a step and say, let's just get the contract in the system. We'll track the rest as we go. Now for equipment, you'll see this splits into internal and external. My internal, again, works very similarly to our labor where I can select, I need excavator three sixty four here for eighty hours, or I could say, I just know I'm gonna need an excavator there for eighty hours. And we can have a budget rate affiliated with each type of equipment that we have in the system. What I can also do is put together external equipment, which is where I would be able to say, I need to rent a dumpster. It could be an item from my catalog. It doesn't have to be. And say, I'm gonna need a dump dumpster on-site for fourteen days, and they usually charge me a hundred dollars a day, and I can have that automatically, part of the budget as well. And so this is where we have that, ability to now later on track, our vendor interaction with vendor, with dumpster rental. But, again, I could track my actual hours spent for the excavator versus what we had, initially, planned on when we set up our budget. Then, again, the last option here will be this idea of miscellaneous, where I have the ability to say things like, I'll need to buy a permit, and they'll usually charge me around a hundred and ninety dollars. So now we have a pretty big budget set up for this project. I'm gonna switch this job back to active mode, And I'm gonna do that so we could see that this project has a total budget of twenty eight thousand dollars, you know, twenty eight thousand two hundred ninety dollars, I should say, to be more specific. I can see it broken down into materials, labor, subs, equipment, miscellaneous. I can also see it broken down to demolition and framing, and each of those could be expanded into its own individual categorized budgets. And then the categorized budgets can have their own set of detail underneath them so I could see how we are performing, against what we had initially set up here, to see which individual lines of the budget may be, sending us, over cost or under cost as we go. And so this is kinda how we have the ability to see all of this at any point in time. And then if I need to make an adjustment, let's just say the scope of work has changed mid project. If I need to now change these budget numbers, I just go to these three dots in the top right corner. It's called the kebab menu, and I'll say switch to budget mode. And I can add more phases. I can adjust quantities. I could do anything I need here to change the budget so that it represents, what we now expect the new final cost of the job to be based off of the new information that's been provided to us. Now, again, this webinar is meant to be mainly on budgeting, so I'm gonna do my best to not get too deep into other topics. But because of how slick we try to make nullified, the budget does interact with other parts of the system. So I wanted to show you a little bit more about how that all works. So now that I have my budget, I can click this create proposal button, and you'll see that we're prompted for use project plan phases in my proposal. What that means is that know if I will create one line of the contract for each phase of the job that we budgeted. If I know what my markup needs to be in order to quote a a price that's gonna be, profitable for, me, including all of my overhead contingency, etcetera, I could write in my markup percentage. And we have the ability to do this, either on a category at a time. So apply this to all materials or just to everything that we budgeted. And just like that, because I spent so much time putting together a nice detailed budget, I can have a contract put together really quickly. I can also make my contract more detailed as a result of this by saying enter breakdown or bill of materials. Let me go to the other one where I actually have a breakdown and say, my materials from the plan, labor from the plan, equipment from the plan. As I pull all these things, the those can be displayed on the document as well. So, again, without me having to reenter things too often, I can just pull information from my plan and track into the contract and, have that budget be useful for other means throughout nullify. The other place the budget comes in handy is gonna be when we're tracking our actual cost. So as I incur cost, I can see these bars update. So one thing we'll see right off the bat, I can, quickly allocate materials. Oh, this is gonna end up being over budget, so it's all red. I can enter some time. Let's see if I came in under budget. I could see progress through the job, and now here's my actual cost versus my budget cost for these individual categories. But where I put together a detailed budget, I can actually use that and say things like create purchase. I'm buying these things. And really quickly, without me having to enter too much additional information, I generate a purchase order which could be emailed to my vendor right through nullify. So, again, we use that budget, yes, to estimate how much we're gonna spend, but then when it comes time to actually spend the money and order the the materials and incur the cost, our budget helps us there as well to prevent the, idea of double entry. And then if things end up going over budget so let's say I've now received a bill for, these materials and the unit price of lumber has, significantly increased, I'm gonna be able to see this information. So I can start by saying, okay. Well, framing is under budget, but the materials for framing are over budget. Oh, I see. We spent twelve thousand dollars on lumber. We thought it was gonna be fourteen hundred. Well, when I ordered them, I thought it was gonna be seven dollars. When I received the bill, it ended up being ten dollars per unit. And that's the idea of, being able to start at our nice detailed budget, but then track down what ended up resulting in overages, what ended up coming in under budget, things along those lines as well. Now, again, this can be done at the labor level. So I budgeted how many hours of each type of user that I want to, that I expect to, have completed this job. But just for the sake of example, I budgeted labor hours and business and, foreman hours. But what if the business owner spends time on this job? Even though I didn't budget for this, it's still tracked as actual cost on the job. And this is part of that separation of actual versus budget. I can still see, yes, I've spent three hundred and twenty eight dollars out of the, forty three hundred dollar labor budget for this phase, I could see laborer zero out of forty, foreman zero out of ten, business owner eight hours spent. So it still couples up under this budget, but it's not trying to fill in anything that I didn't plan for. Because I wanna be able to see, okay. Yes. We did go complete this under budget, but we need to know for next time. The business owner will need to be a part of this phase so I can plan accordingly. So this is where we get this concept of not everything is about dollars and cents. Sometimes I wanna be able to see actual units. I wanna see hours spent as well. This way, if the cost of labor changes, but there's no major technological advances and, it still takes just as long to complete things, instead of me looking, oh, it's cost me this much last time, That's great to know. I wanna say, it took me this many hours last time, and that's how I set up my budget, for future cases. And so that's the type of power that we get when it comes to setting up detailed budgets and then being able to track all of our detailed costs against them. And, again, we'll see that we have the ability to track other things. So, with our subcontractors, I can add the subcontractor here, know if I was gonna remember and say, well, what are they doing? This is my drywall contractor, and I can generate the subcontract here. And I could see, okay, four thousand, contracted, spent out of fifty two hundred budgeted. I could see it was all Sabino's contractors. And then this is where we get into things that are more actual costing than, the concept of, budgeting. But since subcontractors is a little bit of similar overlap, I don't just see the amount that they contracted, but also the amount that they've billed to date and the amount that we've paid them to date through the life of the job as well. So, again, I get to start at this high level, fifty two hundred dollars for contractors, but then I can see, how much was, in the contract, how much we have been re been billed by them, and how much has been paid. So, again, we always have that idea of we start high level. And then as the job goes on and we receive more information, we could drill down into more detail here. Again, the equipment is gonna track just like, our labor time does, so, I would enter hours for the different type of equipment. And then for vendor expenses that aren't material, and we I believe the next webinar we do in the series gets a little bit more of a deep dive on specifically tracking vendor costs, so, we'll get into that, in more detail. But, what we essentially would do is determine on a vendor by vendor basis, what type of category is, this vendor used for. So ABC Supply is a materials, supplier. That's great. But when I, rent equipment from this company that I cleverly called Equipment Rental, we know that this comes in as external equipment based off of that information. And so that's where we can start getting that detailed actual costing versus the detailed budgets that we break down. And the last thing I'll show as part of this deep dive is the concept of WIP reporting. And this is the idea of, let me look at my cost versus budget and compare it to my contract value and see how much earned revenue we haven't invoiced yet. So for this job, I budgeted twenty eight thousand dollars roughly, and the contract is for forty two thousand dollars. Now I've spent ten thousand out of that twenty eight thousand dollar cost. So, just it looks like just over a third of this, but I've invoiced zero percent. And what this work in progress number is showing us is basically, if if I look at this percentage, our cost versus budget percentage, and I apply that percentage to the contract, it's saying, well, you should invoice fifteen thousand dollars. And if it's not making sense and you have more questions, you can click on this view details, and it's gonna say, your cost budget is twenty eight thousand two hundred and ninety. You spent ten thousand and fifty six. You so you've spent thirty five point five percent of your budget. The contract value is forty two thousand of which I haven't invoiced anything of. That's zero percent. So my WIP is gonna be thirty five point five percent of my job, total value here. Now as I invoice this job, let's just say I wanted to round up, and I'm going to invoice for forty percent of the job, which is perfectly acceptable. What's gonna happen to that WIP number is it's gonna recognize that we've invoiced a larger percentage than we have, spent from a budget standpoint, and it's gonna bring that WIP to a negative number. Now a negative WIP doesn't necessarily mean a bad thing. It just means that if we look at how what percentage of the job we have spent and what percentage of the contract we've invoiced, the invoice percentage is larger than our spent percentage. So I've invoiced forty percent of what is totally, the contract value the total value of the contract. But I've only spent thirty five point five percent, so that mismatch is what's giving us, hey. You've technically overinvoiced eighteen hundred and ninety dollars. Usually not a big deal when they're this close together, but this just gives me that information as we go. So it's saying, hey. Yes. You currently are looking at, you know, this six thousand nine hundred and eighteen dollar, profit, but you can expect, eighteen hundred ninety less in, revenue while the job goes on based off of the information that Noify has. And that's just how that's gonna live through the life of the job. This WIP number is just gonna be there to kinda help you understand, where you stand in progress as far as invoicing versus spending goes, each step, along each step of the way. That's really all I have for budgeting. Again, I really can't express enough. The real power here is that we get to start high level. I've spent ten thousand dollars on this job. I budgeted twenty eight thousand. Now here's my breakdown for material, labor, sub equipment. Here's my breakdown for each phase of the job, but then I wanna expand each of these into their own labor, material, subcontractor equipment, miscellaneous budgets. I could see which ones I'm doing better and worse on and then expand each of those into their own individual lines so I could see this is exactly why I'm over budget on this project. Is this material cost me more than expected? Now I know for next time. I still only bought two hundred. I just need to know that next time, I should expect to spend more per unit as opposed to expect to buy more units. And, again, I can get that information as I go. I saw a couple questions come in, so I'll go ahead and jump to our q and a now. The first question is, is there a setting that I can can enable to notify me when I'm nearing my budget limit? There isn't at this point in time, but we are looking into having something like that be available. Definitely submit that into our feedback portal. If you're not familiar with it, the feedback portal is here, question mark, notify feedback portal. And if you put it in and other people have entered this, it helps, bump it up in priority. You can also vote on other people's feedback. But one thing I will direct your attention to is that in my filters, I can actually say, show me budget overrun in materials, and I can filter out to jobs where we're over budget. So that one that we just use as our example shows up right here, right off the bat. And then, again, this could be filtered to, anything if I'm completely over budget, cool, and that's in that fits that description. But here's a handy tool that you can have just to see where you need to provide, the most information, sorry, the most attention. And then, similarly, I could say, show me work in progress that is, higher than zero, so a positive number. These are jobs where we probably should be invoicing because we've spent the money, but we haven't sent that invoice yet. Alternatively, show me projects with a negative whip. Here are jobs that we're either performing really well on or ones that we can expect to spend more money as we go. So there's a lot of power in, these, filters as well to see the specific jobs that need our attention at any point in time. There is a question. We use a third party freight that we separate as a different phase that we call shipping, and they track as subcontractors, subcontractors, because there's multiple POs to each, and they find it hard to budget using the subcontractor option. So I will say this does somewhat fall under the idea of, tracking miscellaneous. So you still have the option to create multiple purchase orders against multiple lines of a budget in that miscellaneous. So I could come in here and say shipping, and there's only one category I need to budget. That's miscellaneous. And I can write in freight and put in, my budget here and then track all this as we go. The important thing would then be just making sure that the vendor is tracked so that freight company is tracked as miscellaneous. And then as we are tracking our cost against this, it knows to put it against the miscellaneous budget instead of the material or equipment or subcontractor budgets. There's a follow-up about thirteen day you know, QuickBooks Enterprise has a thirteen day cash flow projection, and if that's possible to do in nullify. That's not necessarily possible. I think our WIP number is the closest thing that we can have to that. You can even run reports to total up WIP, in columns to see, okay. Here's our WIP over a period of time. But QuickBooks is really strong at cash flow based reporting, so I would still recommend to use their system. And it's still gonna get information from Noify. It's gonna get your outstanding, receivables and payables so you could see what you expect to have your cash flow do over the course of time with due dates. But, yeah, I think, like, using QuickBooks is probably gonna be your strongest way to do cash flow projections at this point in time as opposed to trying to work something additional into nullify. What'll also be nice about that is that it has projections for nonjob related expenses, you might not be entering in nullify at this point in time. Is there a way we can limit access for project manager so we could add all the info but not see the financial project's profit and loss? That's a good question. So, I always do recommend kind of as an initial disclaimer that you create a temporary user with different sets of permissions. You can test them out and make sure that everyone sees what they are supposed to see. But you should be able to set up a workflow of let me start from scratch where I could say they this is a user that manages or estimates jobs, which basically says they could put together budgets, but they can't see job financials. They can't see client agreements. So this person is someone who can budget but can't see actual cost, can't see, revenue on a project, things like that. And then to get even further down the permissions rabbit hole here, in advanced permissioning, I could say, just to be really strict, in order for you to see cost, you have to be an admin or have unlimited approval. In order to see job profitability, you need to be an admin or you need to have, unlimited approval. Things like that can really help you, get more granular with your of permissions so that the people who log in, without the correct set of permissions are limited to only the actions that you want from them. I already hid the question that came, so I'm sorry I can't revisit the exact permission set. But if you work with your success manager or our support team, we should be able to find a layout that works for you of here are the permissions that you need. It's very rare that there's a permissions request that can't be solved with the, standard and advanced permissions that are available in Noify. So definitely don't be shy about reaching out to us to try to find something that works specifically for you. But, again, definitely recommend, fiddling with different, permissions on a fake user. Log in as that user, see what it looks like, and just kinda explore to make sure that, there's nothing, that, employees can see that you don't want them to see. There's a follow-up. There are another question. Is committed costs are not actual or spent costs? Is Noah Fowler going differentiating between committed and actual? The job p and l isn't very helpful, because it includes committed actual and then a space for projected. So, oh, until it includes committed actual in the space. Fair enough. So under customize in cost management, you can actually choose use actual cost instead of committed costs. So if I select this, it's gonna remove all purchase order costs from my job, and it's actually I shouldn't I always it bugs me that we use the word actual cost because actual implies cash flow, but it's accrued cost instead at that point. And so once I check this box, it's gonna adjust all of our cost, to only account for, bills that were received, on vendor interaction instead of looking at the purchase orders. So if I look at this project, earlier, I had a subcontract of four thousand dollars that showed up as cost. That's no longer there anymore because the subcontract until billed isn't actually cost. So I'll go to framing, subcontractor, use Sabino's contractors, zero spend out of four thousand budgeted. That's fine. Contract value, four thousand. When I add the bill here for twenty seven hundred dollars, whatever it's gonna be, that's what now applies the cost to the job so that we can function on an accrual basis instead of a committed basis. Now, there was a a follow-up on that question that there's no reporting that shows all three at once, as in, committed and accrued and budgeted. That is correct. At this point in time, I don't believe we have any reporting that shows all of them, but that's great feedback. We should be able to offer more of that with time. In the meantime, here's just a great way for you to be able to get your account set to accrued costing instead of, committed costing if you're not interested in seeing purchase orders tracked as actual cost. I like having the purchase order cost show, so I was, to keep mine committed. But, that does seem to be the last question that came in. I hope that this was helpful for you guys. Again, I really appreciate people taking the time to join in and, learn more about nullify in these webinars. If you have more questions that come up, don't be shy about reaching out to your success manager, or you can reach out to our, support team, and we can connect you with your success manager. You can reach out to me directly if you have product feedback or just chat about Nullify, you know, we're happy to be here for you guys and, hopefully, offer the best pop, software possible. Thanks, everyone, again. I hope you have a great rest of your week. Take care all.

QuickBooks

PricingTraining & support

QuickBooks

PricingTraining & support